Whether you are a first-time buyer or have prior experience in climbing the property ladder, saving for a house deposit is the first step to getting in the door of your new home. In this blog, you can find useful resources to ensure your savings are as efficient as possible, whilst also learning some top tips and alternative saving methods along the way!

So, what are some top tips on how to save for a house deposit fast?

Keep reading to find useful tips and advice on saving for a mortgage deposit, along with helpful tools to assist you with achieving your savings goals.

Saving for a mortgage can be challenging to plan and navigate when it’s your first time. Therefore, we have put together some of our top tips to make the process a little easier for you.

Standing orders and direct debits are useful to avoid unnecessary spending and to maintain consistency with your savings. Having these arrangements set up every month can make all the difference when saving for a mortgage deposit.

It is easy to feel overwhelmed with all of the banking options out there; however, keeping your investment goals in mind can help you find the best one for you. Things to look out for when choosing the right accounts include the following:

Reviewing your current spending is another tip for first-time home buyers. Monthly subscriptions are an example of where your expenditure may be building up without you realising. Having a monthly automated outgoing can make it hard to keep track of your finances. There are many tools out there that can assist you in getting those expenses down, such as subscription tracking apps like Bobby and Rocket Money.

Another top tip is to create a spending diary; log all expenditure for a month and review what can be cut down. This can help you visualise your outgoings and therefore ensure all non-essential expenditure is fine-tuned to the necessities.

Budgeting and saving need to be realistic. If your current plan isn’t working for you, change it! Saving for your house deposit is exciting, and should be done in a way that still allows you to enjoy life. Naturally, some months are more expensive than others, which is why it is important to review your saving habits regularly.

There are many resources to assist you with this, such as financial planning journals like Papier, and apps like Pocket Guard!

Renting can cause a significant impact on your budget, so it’s always a great first step to decrease this where possible.

Moving in with a friend or housemate is a great way to cut down on your rental expenses. Search around to see if anyone is renting a room on flatshare websites. You could also try to find somewhere closer to your frequently visited locations to save money on commuting.

It’s easy to get ahead of yourself when mentions of financial gain arise, such as promotions, inheritance, or monetary gifts. Should these plans fall through, you can not only be left unmotivated, but also set a long way back in your savings goals.

Ensure your goals and targets are always realistic, relevant and aligned with your life’s trajectory.

Using SMART targets is a great way to keep your goals optimal for your circumstances. To do this, ensure your savings goals are:

There is also the option of cutting down any non-essential expenses to keep your focus on the bigger picture of saving for your mortgage deposit.

There are many different types of helpful bank accounts available to assist you in saving for a house deposit fast. Find some below:

Lifetime ISAs (Individual Savings Accounts) include a government contribution of 25% on all deposits into the account as a bonus to your savings, capped at £1000 per year! These accounts are perfect for a first-time buyer. There are age restrictions on Lifetime ISAs; most commonly, you must be between 18 and 40 years old to open one. You can find further information on Lifetime ISAs on the Government website.

A Bonus Saver Account tends to offer a higher interest rate for a certain time. This higher interest rate can decrease based on the withdrawals made.

As saving for a mortgage deposit is a longer-term goal, interest rates are important. If you want to use a regular savings account, be sure to check that the interest rate is optimal. These accounts usually also have easy accessibility to your money, and are therefore beneficial if your investment timeframe is 1-3 years.

Methods such as investing in cryptocurrency or certain stocks can be too volatile for saving for your mortgage deposit as there’s no financial protection for these investment strategies.

Comparison websites are a great starting point when looking for the best savings account for your individual needs.

Be sure to research features you need from an account before opening one, such as bonus options, low or no account fees, easy management, etc.

Your house deposit savings don’t need to be kept entirely in the same place! Utilising options such as Lifetime ISAs, which have a lower deposit limit, such as £4,000 per year, whilst also investing in a high-interest account, can speed up the process of accumulating your deposit. You can get the best of both worlds!

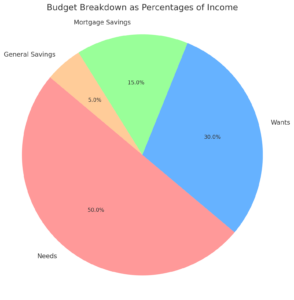

Several factors, such as your budget, lifestyle and financial habits, come into play when saving large amounts of money. Generally, you can expect to be saving for 3-10 years, depending on income, location, and additional expenses. As a rule of thumb, you should aim to save at least 10-20% of your take-home pay each month.

There are many schemes out there to help you save for a house deposit fast. Educate yourself on the options below.

If you are a first-time home buyer, you may be able to purchase a home for 30-50% below market value. This is called the Government First Homes Scheme.

The home can be:

There are limits to the scheme – new build First Homes cannot cost more than £250,000 (or more than £420,000 if the property is in London) after the discount has been applied. The local council can lower this maximum price.

You can decorate or improve your property, but if you let or sell your property, you’ll need to follow the First Home scheme rules.

Rent to Buy is a scheme that’s designed to help (mostly) first-time buyers secure a deposit for their home. Under the scheme, tenants pay a reduced rent, typically at 80% of market value, with the expectation that they will save up a deposit to buy a property. Read our informative blog: Rent to Buy is a clever pathway to home ownership.

To learn more about further schemes and tips for first-time home buyers, find all the information you need in our recent Blogs.

Another scheme that can assist you with purchasing a property is opting for shared ownership. This can be useful if you can’t afford all of the deposit and mortgage payments required on a property. It works by purchasing a share of the property and then paying rent to a landlord on the rest. Find out more about the Shared Ownership Scheme using our Shared Ownership Hub.

Saving doesn’t need to be as daunting as it seems! There are many ways to make saving for a house deposit fast, fun and easy.

Savings challenges can be extremely effective if maintained. For example, the 1p/365 challenge consists of saving 1p on day 1, 2p on day 2 and so on – this results in £667.95 saved in a year!

Similarly, just saving £1 per day results in £365 saved in a year. This challenge is great as you can really tailor it to your budget, simply raising the £1 a day to £5 a day gives you £1,825 per year!

Having systems such as round-ups in place can unconsciously help towards your savings targets. Round-ups are where banks such as Monzo or Starling automatically round up each card purchase to the nearest pound and save the spare change for you – Take care of the pennies and the pounds will take care of themselves!

In short, saving for a mortgage deposit efficiently relies on commitment to your goals and planning accordingly. Budgeting easily fails if you are unrealistic with your targets, so don’t be afraid to adjust your plan if it isn’t working – saving is not a punishment!

For more information on the different paths available to you. Along with further advice and expert knowledge on how to save for a house deposit fast, read some of our recent blogs below. Our friendly team is here to help you with any queries. Simply contact us here.