17/11/2025

Article by: Plumlife

So you’re at a point where you can start considering your next (or first) property purchase. Congratulations! But there are so many things to consider, and one of the most fundamental choices is between a new build vs old house. Whichever you prefer will come down to personal preference, but let’s start with one question: […]

30/09/2025

Article by: Plumlife

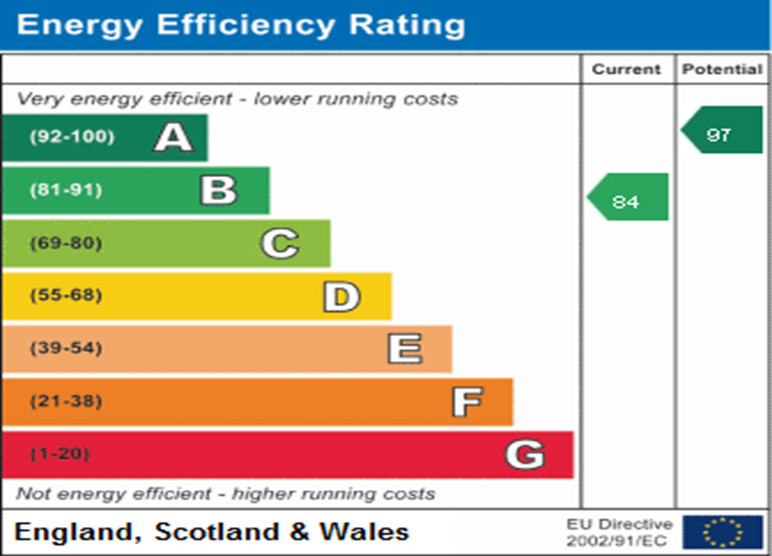

Have you looked at your energy bill lately, or is it too much to handle? That might not be the case if you’re living in a new build home. Energy bills in new builds are often said to be cheaper, but is that true? And — if so — why do new builds save so […]

30/09/2025

Article by: Plumlife

You did it! You made it into your new home. Now, let’s turn this blank canvas into a home worth showing off. In this blog, we will explore 5 tips from us here at Plumlife to help you discover and create your dream home. So, what are our top tricks for decorating a new […]

30/09/2025

Article by: Plumlife

There’s a question all prospective homeowners must face at some point in their buying journey – do we go old or new? Many will sing the praises of existing builds, but they can prove inaccessible to many, especially first-time buyers. It can all leave you wondering, what are the benefits of buying a new build? […]

01/08/2025

Article by: Plumlife

Whether you’re looking for your first home or your forever home, new builds offer something for every homebuyer. Navigating the vast property field can be challenging, with numerous options available. Let us narrow it down for you! So, why buy a new build home? New builds offer something no other home type does – the […]

01/08/2025

Article by: Plumlife

So, you’re buying your first home! Whether you’re buying with a partner, or a friend, or buying solo, this process can be daunting. We’ve put together this blog to make the whole process a little easier by highlighting common mistakes for you to avoid. What are the common first-time buyer mistakes that you should avoid? […]

01/08/2025

Article by: Plumlife

Whether you are a first-time buyer or have prior experience in climbing the property ladder, saving for a house deposit is the first step to getting in the door of your new home. In this blog, you can find useful resources to ensure your savings are as efficient as possible, whilst also learning some top […]

01/08/2025

Article by: Plumlife

Getting a foot on the property ladder can feel increasingly out of reach for many first-time buyers. With house prices continuing to rise in recent years, high deposits, and tough mortgage criteria, shared ownership provides a potential alternative. But is it a sensible idea for a first-time buyer? Shared ownership offers a middle ground between […]

01/08/2025

Article by: Plumlife

The Shared Ownership scheme is a government-backed initiative designed primarily to help first-time buyers enter the property market. Shared Ownership homes allow buyers to only pay for a deposit on an initial share of a property as opposed to buying a home outright, which requires a far greater upfront cost. So, what are the Shared […]

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |